Dear Earth Citizen

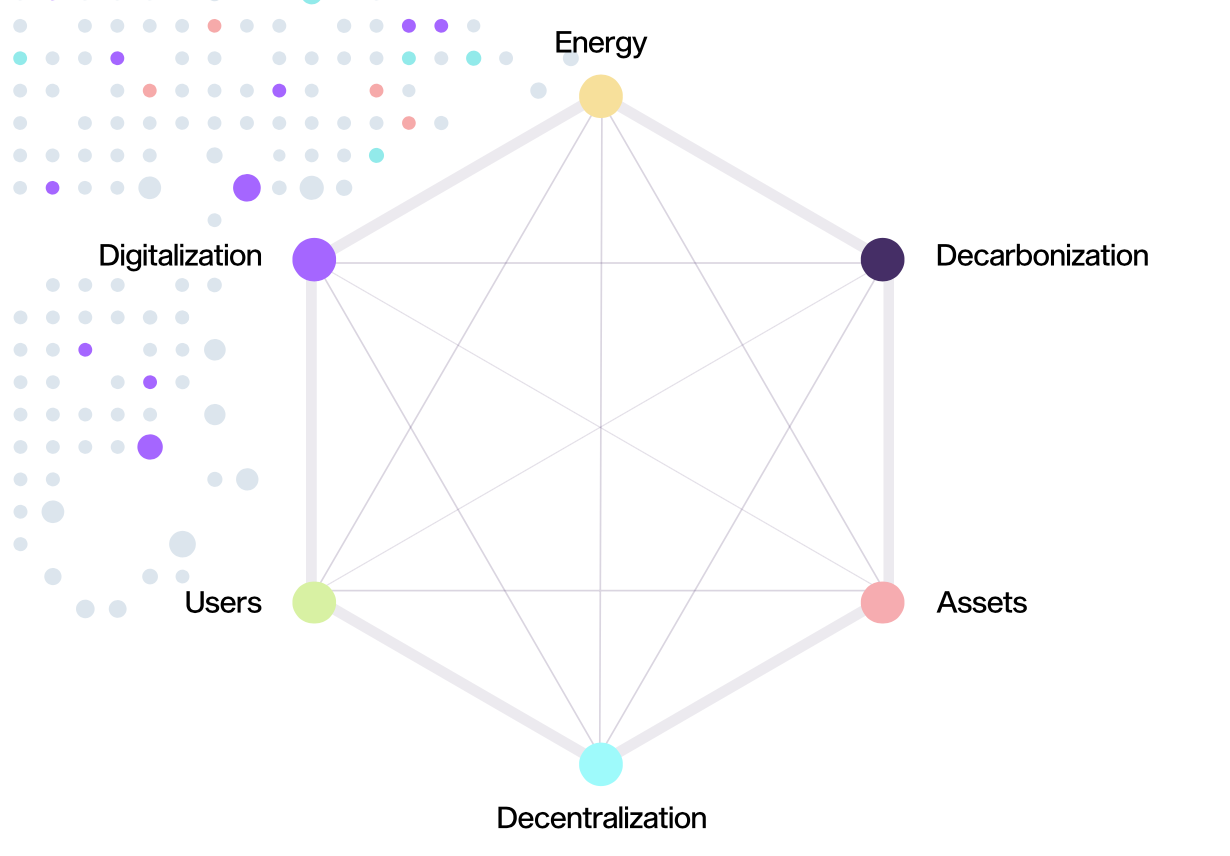

This week we look at The Energy Web Token $EWT and how this has evolved as the native cryptocurrency of Energy Web. Energy Web builds operating systems for energy suppliers, aggregators and grid operators, with the mission to “accelerate decarbonization of the global economy.”

The Energy Web Foundation (EWF) is working to accelerate the transition to a decentralized, customer-centric electricity system. They are doing this by unleashing the potential of blockchain and other decentralized technologies. The Energy Web Decentralized Operating System (EW-DOS) is an open-source, digital technology stack that enables any device, owned by any customer, to participate in any energy market. markets. EWF is also working on developing applications for the energy sector that will run on top of EW-DOS. These applications will help to create a more efficient, transparent, and secure electricity system. In addition, EWF is working with a number of partners to build a global community of developers, utilities, regulators, and other stakeholders who are committed to accelerating the transition to a low-carbon, customer-centric electricity system.

Energy Web Token and Chain

In mid-2019, EW launched the Energy Web Chain as the world’s first enterprise-grade, public, open-source blockchain platform tailored to the sector’s regulatory, operational, and market needs. The EW Chain anchors a broader technology stack known as the Energy Web Decentralized Operating System (EW-DOS), a blockchain-plus suite of middleware, toolkits, and other digital solutions to support the energy transition. The goal of EW-DOS is to help markets crypto green-energy blockchain accelerate the shift from central station power generation to a cleaner, more distributed system based on renewable energy sources such as wind and solar. In doing so, EW-DOS will create new opportunities for companies and consumers to participate in the energy system through markets crypto green-energy blockchain decentralized applications (Dapps) that run on top of the platform. By making it easier to develop and deploy Dapps that solve real-world problems in the energy sector, EW-DOS has the potential to spur innovation and drive down costs across the industry.

EW Chain is the only blockchain in any sector where well-known companies run the network’s validator nodes. A September 2020 blog post puts the number of nodes actively securing the network at 30. PoA is generally considered one of the most centralised blockchain validation systems, as the node operators are generally selected by the project developers.

$EWT is used to pay for services and gas fees, which get distributed to the PoA validator nodes that secure the network.

As of April 20, EWT had a trading value of $USD 5.75. The maximum supply is capped at 100 million, of which 30 million are currently in circulation. A recent trading volume of $2.63m was 1.5% of the $172.9m market capitalisation. The primary centralised exchanges supporting $EWT trading pairs are Gate.io, KuCoin and Kraken.

The circulating supply of $EWT

$EWT has a finite supply of 100 million.

The token can be transacted across both the Energy Web and Ethereum Network across the EWT Bridge.

Note that the community fund is increasing over the next ten years. The picture below shows the circulating supply in detail:

Out of the total supply, 14,093,276 tokens were distributed to the Energy Web Team as an endowment. Another 10,000,000 ETW tokens were given to two founding organisations. A further 4,061,709 tokens were dedicated to a community fund, which should continue increasing over ten years.

Technical Review of $EWT

All prices shown are as of 19/05/2022 at 21:00 UTC+5

In the long run, $EWT is impacted by this bearish move.

From an Ichimoku point of view, prices have been driven by the Weekly Tenkan since the end of 2021. If we use a Fibonacci Extension, prices are still supported by technical areas. This week, it would be an excellent sign to close the candle above the 100% Extension to have an opportunity to bounce on.

At $USD 4.2, the previous support will be a resistance for the future; this area is interesting because it will be a well-defended area by bears!

This week was a challenging juncture. Volumes were significant and confirmed that bears are in the game.

It will take time to reverse this trend, maybe months at least. But it allows for evolution as the crypto market matures, and moves forward with exciting prices for investors looking to this kind of period to buy assets!

Daily Chart

From a short term point of view, it remains challenging:

Prices are driven by the Daily Tenkan and no “bullish alert” on the Ichimoku indicator.

Also, the Fibonacci Extension is now a resistance to break for not going lower. So $USD 2.9 is the target to break.

Otherwise, positive news. The Daily RSI is showing a bullish divergence, and the fact that the line is out of the oversold area shows a possible strength from the bulls, so it gives the possibility for prices to bounce! Let’s see how it goes in the next few days.

In Summary

With good fundamentals, a finite supply and a united community, $EWT has a lot of potential. However, the technical indicators are that we will have to be patient before seeing any bullish momentum. But the time will come, and prices will recover from the past week's market sell-off. An investor has to be objective but also optimistic. Even if cryptocurrencies are terribly volatile, their potential still remains excellent. If you believe in investing in a project for its long-term potential, the $EWT is a good bet.

Thank you for reading, dear Earth Citizen, and see you next week for another Technical Review. Take care in these markets!

Romain

Not financial or tax advice. This article is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. For tax advice talk to your accountant. DYOR – do your own research.